It was a fairy-tale victory for Javier Milei. In December 2023, the fiery libertarian economist and political outsider swept Argentina’s presidential election, promising to dismantle the country’s bloated state, dollarize the economy, and end decades of economic mismanagement. His rise was nothing short of meteoric—a self-proclaimed “anarcho-capitalist” who captivated a nation weary of hyperinflation, currency controls, and political corruption. Milei’s early days in office seemed like a dream come true for his supporters: he slashed government spending, cut subsidies, and championed Bitcoin as an alternative to Argentina’s inflation-ravaged peso.

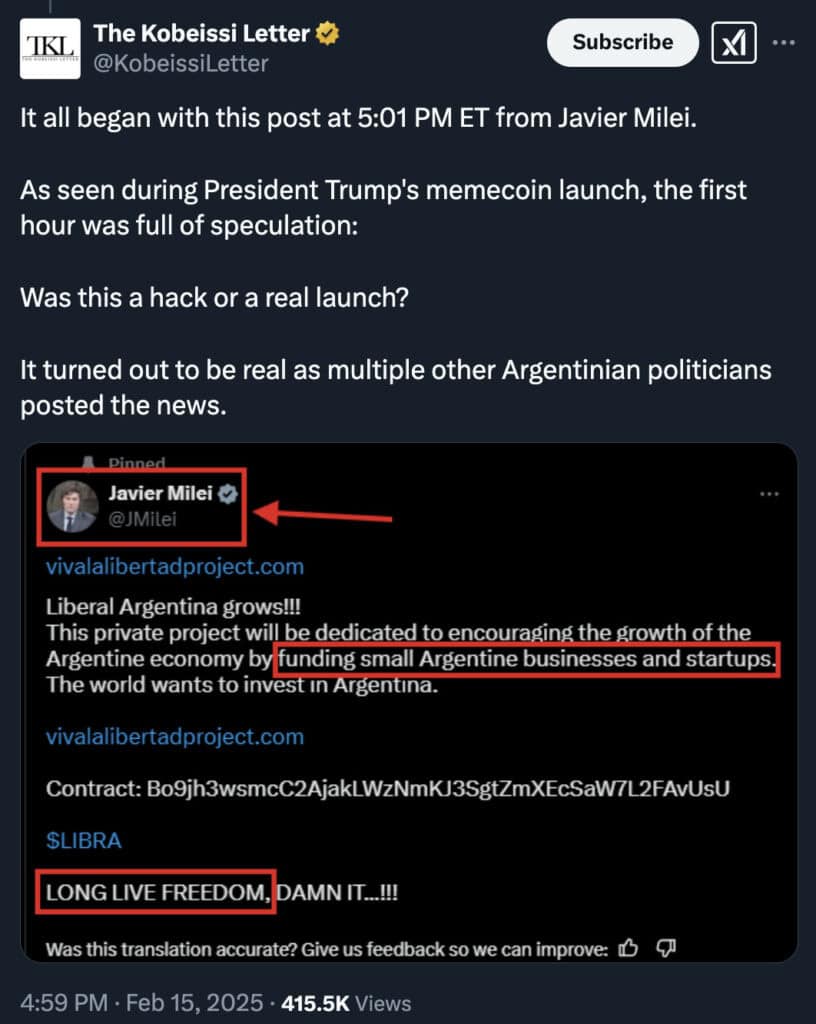

But that dream took a sharp turn in February 2025, when a single tweet about a little-known cryptocurrency, $LIBRA, sent his presidency spiraling into chaos. What began as a bold endorsement to fund small businesses ended in a spectacular crash, fraud allegations, and calls for his impeachment. Now, the man who promised to save Argentina’s economy finds himself fighting for his political survival. Milei’s now-deleted tweet endorsed a little-known cryptocurrency, $LIBRA, which surged and then crashed within hours, leaving thousands of investors in the lurch.

This isn’t just a story about a cryptocurrency crash—it’s a cautionary tale about the intersection of politics, finance, and the unregulated world of digital assets. For subscribers, we dive deep into the $LIBRA scandal, exploring its implications for Milei’s presidency, Argentina’s economy, and the future of cryptocurrency regulation in the region.

The Tweet That Sparked a Firestorm

On a seemingly ordinary Friday evening, President Javier Milei took to X (formerly Twitter) to promote LIBRA, a cryptocurrency he claimed would encourage the growth of Argentina`s economy by funding small businesses and start-ups. The tweet, which framed the token as a tool for economic growth, sent the price of LIBRA soaring to nearly $5.

But the euphoria was short-lived. Within hours, the token’s value plummeted to less than $1, wiping out investments and sparking outrage. Milei quickly deleted the tweet, citing doubts about the project, but the damage was already done.

Critics were quick to draw parallels to a “rug pull,” a notorious crypto scam where developers abandon a project after inflating its value, leaving investors with worthless tokens. The question on everyone’s mind: Was Milei complicit in the scheme, or was he simply naive?

Milei’s Defense: Gambling, Not Fraud

In a televised interview with TN news channel, Milei defended his actions, comparing investing in $LIBRA to gambling. “If you go to the casino and lose money, what is the claim if you knew that it had those characteristics?” he argued.

The president insisted he acted in good faith, claiming he believed the cryptocurrency would benefit small businesses and stimulate economic growth. He also denied any personal gain from the promotion, stating, “I did not promote it. What I did was I spread it.”

However, his explanation has done little to quell the backlash. Opposition lawmakers and legal experts argue that Milei, as the head of state, had a responsibility to vet the project before endorsing it. His failure to do so, they say, demonstrates a reckless disregard for the financial well-being of Argentines.

The Fallout: Impeachment Calls and Legal Battles

The $LIBRA scandal has ignited a political firestorm in Argentina. Opposition lawmakers, led by Leandro Santoro of the opposition coalition, have called for Milei’s impeachment, labeling the incident an “international embarrassment.”

Meanwhile, criminal complaints have been filed against Milei, the developers of $LIBRA, and other individuals involved in the project. One complaint, filed by the Popular Unity political party, alleges an “illicit association to commit an indeterminate number of frauds.” The plaintiffs accuse the group of orchestrating a “MEGA scam” through a classic rug pull operation.

A judge has been appointed to investigate the allegations, raising the possibility of legal consequences for Milei and his associates.

Broader Implications: Milei’s Libertarian Vision Under Scrutiny

The $LIBRA scandal strikes at the heart of Milei’s libertarian ideology, which champions free markets and minimal government intervention. Since taking office in December 2023, Milei has been a vocal advocate for Bitcoin and cryptocurrencies as alternatives to Argentina’s inflation-ridden peso.

While his vision has resonated with many Argentines desperate for economic stability, the $LIBRA incident highlights the risks of unregulated financial markets. Critics argue that Milei’s hands-off approach to cryptocurrency regulation has created a breeding ground for scams, leaving ordinary citizens vulnerable to exploitation.

The scandal also raises questions about Milei’s judgment and leadership. As Argentina grapples with hyperinflation and economic instability, can the country afford a president who gambles with its financial future?

What’s Next for Argentina and Crypto?

The $LIBRA scandal is more than just a political crisis—it’s a wake-up call for Argentina and the global cryptocurrency industry. Here’s what to watch in the coming months:

- Legal Proceedings: The investigation into Milei and the $LIBRA developers could set a precedent for holding public figures accountable for promoting risky or fraudulent financial products.

- Regulatory Reforms: The incident may force Argentina to reconsider its approach to cryptocurrency regulation, potentially introducing stricter oversight to protect investors.

- Political Repercussions: With calls for impeachment growing louder, Milei’s presidency hangs in the balance. The scandal could weaken his political capital and embolden opposition forces.

- Investor Confidence: The collapse of $LIBRA has eroded trust in cryptocurrencies among many Argentines, potentially slowing the adoption of digital assets in the country.

Why This Matters

The $LIBRA scandal is a stark reminder of the dangers of mixing politics with speculative financial markets. For Argentina, a country already struggling with economic instability, the fallout from this incident could have far-reaching consequences.

1 thought on “How Javier Milei’s Crypto Endorsement Brought Him to the Brink of Impeachment”